Are you considering investing in Costco stock but unsure how to get the most recent price information? In this article, we’ll explore Costco’s stock performance using the Fintechzoom Costco Stock tool and the factors influencing its value.

Costco, a well-known retailer operating member-only warehouse clubs, has established itself as a global leader with over 800 locations worldwide. Traded under the ticker symbol COST on the NASDAQ, Costco’s stock has seen significant growth, with an average price per share of around $450 as of September 2021. This surge in value has elevated its market capitalization to approximately $200 billion. Over the past decade, Costco’s stock price has increased by over 500%, highlighting its resilience and strength amidst various economic challenges.

Several factors contribute to Costco’s impressive stock performance. The company’s business model, centered on high-volume sales and low prices, attracts a loyal customer base that pays annual membership fees, ensuring a steady revenue stream.

Costco’s efficient supply chain and bulk purchasing power allow it to offer competitive prices, while its solid financial health, consistent earnings, and revenue growth further bolster investor confidence. Additionally, Costco’s commitment to employee satisfaction and its ongoing global expansion enables it to tap into diverse international markets. Tools like the Fintechzoom Costco Stock tool provide real-time data and insights, aiding investors in making informed decisions.

What Is Costco Stock?

The Costco Wholesale Corporation, commonly known simply as Costco, has established itself as a dominant force in the retail industry. This retail giant is celebrated for its extensive network of warehouse clubs, which offer a wide range of high-quality products at competitive prices. With over 800 locations worldwide, Costco has built a robust customer base that appreciates the value and variety it provides. This unique blend of affordability and quality has cemented Costco’s place in the daily lives of millions, making it more than just a retailer but a cultural mainstay.

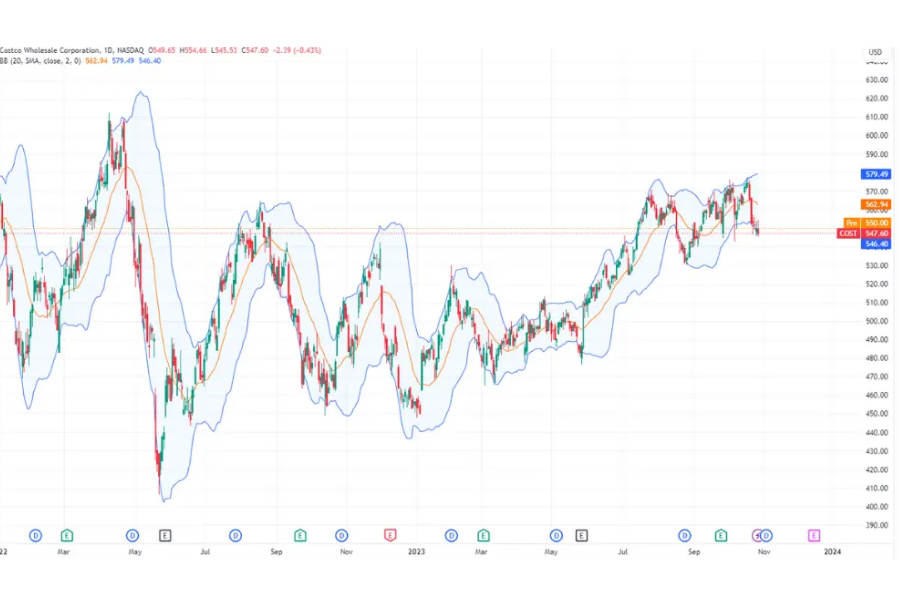

Costco’s stock, identified by the symbol COST on the NASDAQ, has become a focal point for many investors. Unlike the volatility often seen in other stocks, COST has demonstrated remarkable stability and growth over the years. This has made it an attractive option for those seeking reliable long-term investments. Investors are drawn to Costco not only because of its solid financial performance but also because of its consistent ability to adapt and thrive in varying economic climates. The company’s strong fundamentals and steady growth trajectory make its stock a preferred choice for those looking to diversify their portfolios with dependable and profitable asset.

Fintechzoom Costco Stock: Overview

The analysis provided by Fintechzoom on Costco stock offers a comprehensive overview of its performance in the current market landscape. Costco Wholesale Corporation, traded under the ticker symbol COST, is a significant player in the retail industry, widely recognized for its warehouse club model and extensive product range. As of [insert date], Costco’s stock price stood at [insert price], indicating a [insert percentage] change from the previous quarter. This reflects the company’s resilience and ability to maintain robust performance in a fluctuating market.

Costco’s financial health remains strong, with a market capitalization of [insert value] and a consistent trend of revenue growth. The company’s strong fundamentals, including healthy cash flows and a solid balance sheet, provide a competitive edge in the retail sector. Costco’s dedication to customer satisfaction and operational efficiency has been pivotal to its sustained success and the confidence it enjoys among investors. These factors have contributed to the company’s reputation as a stable and attractive investment option.

Analyzing Costco’s stock performance involves looking at key metrics such as the price-to-earnings ratio, earnings per share, and dividend yield. These indicators offer valuable insights into the stock’s valuation and growth potential, helping investors make informed decisions. Overall, Fintechzoom’s analysis highlights Costco’s resilience and strategic positioning in the market, reaffirming its status as a strong and reliable investment choice.

How To Invest In Costco Stock?

If you’re considering investing in Costco stock, there are several options available to suit different investment strategies and risk tolerances.

1. Buying Shares Directly

The simplest method to invest in Costco stock is through a brokerage account. By purchasing shares directly, you have complete control over your investment, allowing you to buy and sell shares at your discretion. This approach is straightforward and gives you direct ownership of Costco stock, enabling you to manage your portfolio according to your financial goals.

2. Investing Through Mutual Funds or ETFs

Another option is to invest in mutual funds or exchange-traded funds (ETFs) that include Costco shares. This strategy allows you to gain exposure to Costco stock as part of a diversified portfolio, which can help mitigate risk. Mutual funds and ETFs often track specific indexes or sectors, and by investing in these, you benefit from the overall performance of a group of stocks, rather than relying on the performance of a single company.

3. Exploring Stock Options

For more experienced investors, options trading presents another way to invest in Costco stock. Options give you the right, but not the obligation, to buy or sell Costco shares at a predetermined price within a specified timeframe. This can be a more complex and riskier investment strategy, as it requires a good understanding of market movements and timing. Before engaging in options trading, it’s crucial to conduct thorough research and consult with a financial advisor to ensure this approach aligns with your investment objectives and risk tolerance.

Risks And Rewards Of Investing In Costco Stock

When considering investing in Costco stock, it’s crucial to weigh both the potential risks and rewards associated with this decision.

1. Potential Risks

Investing in Costco stock isn’t without its share of risks. Economic downturns, intensified competition, shifting consumer preferences, and regulatory hurdles all have the potential to impact Costco’s financial performance and, consequently, its stock price. Additionally, broader market volatility and economic instability can introduce further uncertainties. It’s essential for investors to thoroughly assess these risks and understand how they could affect their investment in Costco stock. By being aware of potential challenges, investors can make more informed decisions and manage their investment portfolios effectively.

2. Potential Rewards

Despite the risks, investing in Costco stock offers significant potential rewards. Costco boasts a strong track record of financial success and market leadership, making it an appealing choice for many investors. The company’s solid financial health, diverse product offerings, and global presence provide a strong foundation for future growth. By investing in Costco stock, investors have the opportunity to benefit from the company’s continued success and take advantage of long-term growth opportunities. By carefully evaluating the potential rewards and staying informed about market trends, investors can make strategic investment decisions that align with their financial goals and objectives.

Understanding How Economic Factors Influence Costco Stock

Economic factors such as inflation, unemployment rates, and consumer purchasing behaviors significantly impact the performance of Costco stock, as analyzed by Fintechzoom. For instance, during economic slowdowns, Costco often benefits from its value-oriented approach. As consumers become more budget-conscious, they are more likely to turn to Costco for affordable bulk purchases, leading to increased sales and potentially boosting the stock price.

However, inflation can have a mixed effect on Costco’s stock. While the retailer’s cost-effective model may attract more customers, rising inflation can also squeeze profit margins by increasing the costs of goods sold. This can potentially put downward pressure on the stock price if the company is unable to pass on the higher costs to consumers without losing its competitive edge.

Understanding these economic influences provides valuable insight into the factors that could affect Costco’s stock price in the future. By monitoring changes in inflation rates, unemployment figures, and consumer spending habits, investors can better anticipate how these variables might impact Costco’s financial performance and stock valuation. Overall, while Costco’s strong business model offers a buffer against economic fluctuations, staying informed about broader economic trends is crucial for making informed investment decisions.

Cracking The Code: Key Factors Shaping Costco Stock Performance

Investing in Costco stock involves considering various factors that affect its performance, from broader economic trends to company-specific dynamics and market behaviors. Here’s a breakdown of these elements to help you make informed investment decisions.

1. Economic Landscape and Trends

Costco’s stock performance is deeply intertwined with macroeconomic factors such as GDP growth, inflation rates, and consumer spending habits. During periods of economic expansion, rising consumer confidence often translates into increased sales and revenue for Costco, positively impacting its stock price. Conversely, economic downturns may lead to reduced consumer spending, affecting Costco’s profitability and stock performance. Keeping abreast of these economic indicators can provide valuable insights into the overall health of the economy and its potential impact on Costco’s stock.

2. Company Financials and Metrics

Analyzing key financial metrics is essential for evaluating Costco’s stock. Metrics like revenue, net income, profit margins, and operational efficiency provide crucial insights into the company’s financial health and performance. A strong financial performance, characterized by consistent revenue growth and healthy profit margins, typically instills confidence in investors and drives up the stock price. Additionally, effective management practices and strategic initiatives aimed at enhancing operational efficiency contribute to Costco’s sustained success and attractiveness to investors.

3. Market Dynamics and Trends

Market trends, including shifts in consumer behavior, competitive pressures, and industry dynamics, significantly influence Costco’s position in the retail landscape. Understanding consumer preferences, such as the growing demand for bulk purchasing, and monitoring competitive developments help investors gauge Costco’s market share and growth potential. By staying informed about these market trends, investors can better anticipate opportunities and risks associated with investing in Costco stock and make informed decisions accordingly.

Technology And Innovation At Costco

Technology plays a pivotal role at Costco, serving as a crucial tool that enhances efficiency in supply chain management and fosters robust customer engagement through its online platform. The implementation of innovative warehousing methods, such as automated warehouses and same-day delivery services, has significantly improved operational efficiency and competitiveness, consequently positively impacting stock performance.

Costco’s utilization of technology has revolutionized its supply chain management, streamlining processes and reducing overhead costs. Automated warehouses equipped with state-of-the-art technology enable seamless inventory management and order fulfillment, ensuring timely delivery of products to customers. This operational efficiency not only enhances customer satisfaction but also contributes to Costco’s bottom line and overall stock performance.

Moreover, Costco’s investment in technology has extended to its online presence, providing customers with a convenient and user-friendly platform to access its products and services. The integration of technology into the online store has facilitated personalized shopping experiences, allowing Costco to engage with customers on a deeper level and drive sales growth. By leveraging technology to innovate and adapt to changing consumer preferences, Costco continues to strengthen its position in the market and drive long-term value for shareholders.

Forecasting the Future: Long-term Prospects For Costco Stock

The long-term outlook for Costco’s stock performance is rooted in strategic market positioning and sustained financial growth amidst evolving consumer dynamics. As Costco expands its physical and online footprint, it stands poised to capture a larger slice of the retail pie. The company’s commitment to offering quality products at competitive prices resonates strongly with consumers, bolstering its financial standing.

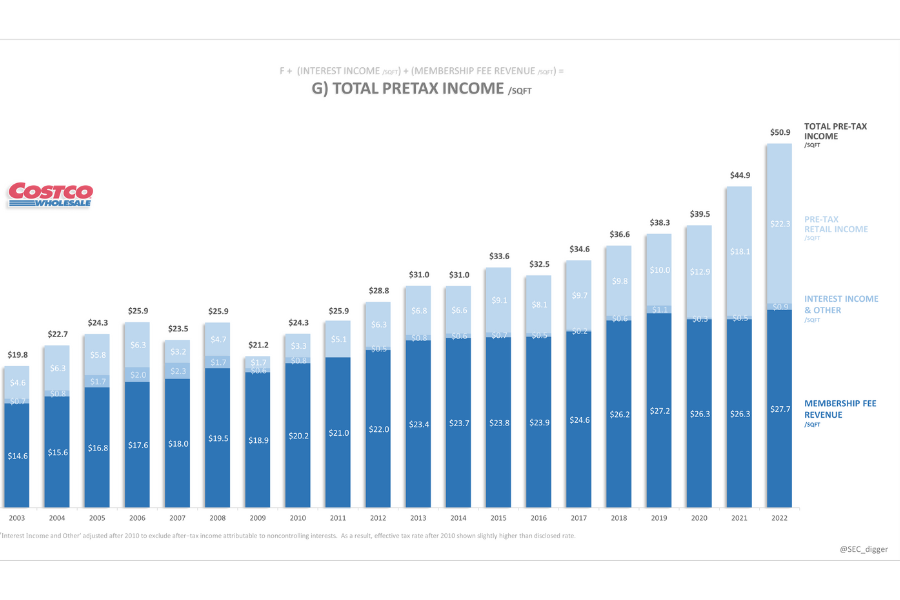

A deep dive into Costco’s historical financial data unveils a consistent upward trajectory in revenue and net income, underscoring a pattern of stable and reliable growth. Furthermore, Costco’s agility in adapting to shifting consumer preferences, such as the rising demand for organic and sustainable goods, positions it favorably for long-term success.

Given these factors, it’s reasonable to project that Costco’s stock will likely continue on its growth trajectory over the long haul. Investors seeking stability and the potential for consistent returns may find Costco to be an appealing long-term investment choice within the retail sector. As the company navigates market dynamics and consumer trends, its steadfast commitment to delivering value could pave the way for sustained shareholder value in the years to come.

Key Points About Fintechzoom Costco Stock

- Costco’s stock, identified as COST on the NASDAQ, has seen significant growth, with an average share price around $450 as of September 2021.

- Costco’s market capitalization has reached approximately $200 billion, indicating its status as a financial powerhouse.

- The company’s success is attributed to its business model focusing on high-volume sales and low prices, attracting a loyal customer base.

- Costco’s stock has weathered economic challenges, experiencing remarkable growth of over 500% in the past decade.

- The Fintechzoom Costco Stock tool provides real-time data and insights to help investors track Costco’s stock performance.

- Economic factors such as GDP growth, inflation rates, and consumer spending impact Costco’s stock performance.

- Key company metrics like revenue, profit margins, and operational efficiency influence investor sentiment towards Costco stock.

- Market trends, including consumer behavior and competitive pressures, play a significant role in shaping Costco’s market position.

- Investing in Costco stock entails weighing potential risks such as economic downturns and increased competition against potential benefits like the company’s strong financial health and global presence.

- Long-term projections suggest that Costco’s stock will likely continue to experience growth due to its strategic market positioning and sustained financial performance.

Summary

Costco’s stock, denoted as COST on the NASDAQ, has seen remarkable growth, with an average share price of around $450 as of September 2021, propelling its market capitalization to approximately $200 billion. This surge underscores its prominence as a financial powerhouse in the retail domain. Economic factors like GDP growth, inflation rates, and consumer spending patterns, along with company-specific metrics such as revenue and profit margins, significantly influence investor sentiment towards Costco’s stock.

Investing in Costco stock involves balancing potential risks, like economic downturns and heightened competition, with potential benefits stemming from the company’s robust financial health and global presence. Long-term projections indicate sustained growth prospects for Costco, driven by its strategic market positioning and consistent financial performance. Amidst evolving market dynamics, Costco remains an appealing investment choice for those seeking stability and potential for steady returns within the retail sector.

People Also Ask (FAQs)

1. Is Costco a good buy stock?

Costco currently holds a consensus rating of Strong Buy, with 19 buy ratings, 6 hold ratings, and 0 sell ratings from analysts. The average price target for Costco stands at $841.87, as per the analysis of 25 Wall Street analysts over the past 3 months.

2. Will Costco stock reach $1000?

It’s unlikely for Costco’s stock to reach $1,000 by year-end while maintaining the current multiple, as it would necessitate a 50% increase in earnings per share. Given the mature nature of Costco’s business, such rapid bottom-line growth seems improbable at this time.

3. Who owns the majority of Costco stock?

Institutional investors own approximately 52.86% of Costco’s stock, while insiders hold 0.82%, and public companies and individual investors own 46.32%. Costco’s ownership structure comprises a mix of institutional, retail, and individual investors.

4. Who is the transfer agent for Costco stocks?

The transfer agent for Costco stocks is Computershare. If your shares are held through Computershare, you can contact them directly at 1-800-249-8982. Otherwise, you may contact your stockbroker for assistance.

Stay tuned for more updates and alerts visit: The News!